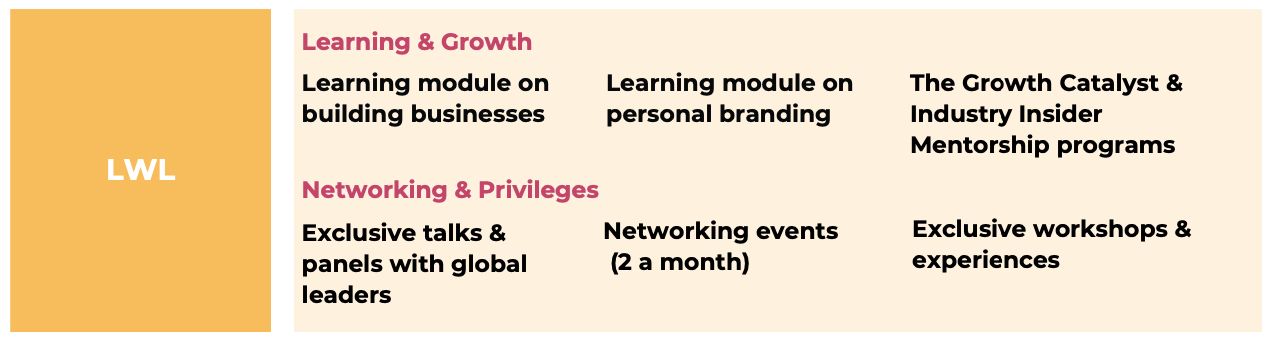

5 Takeaways From Our Entrepreneurs’ Roundtable At Lightbox VC.

5 things we learnt about female entrepreneurs at our exclusive roundtable yesterday at Lightbox VC. We not only addressed hot topics in the ecosystem but went further to suggest actionable scenarios to further build opportunities and access for aspiring female entrepreneurs.

1) Female Founders can and should change the way the game is played.

The problem in the ecosystem is not the lack of founders but the lack of female investors. There are fewer faces across the table that relate to or resonate with how female founders choose to grow their businesses. They may be more conservative in their approach but this is not due to any flaw in the business model but more because they inherently don’t want to take a bigger risk. Again this goes back to basic social factors; not many female founders have collateral such as property or assets in their name to put on the negotiating table. We had a couple of founders in the room who are running profitable businesses even if it has taken them up to 5 years because they chose consistent value creation over growth metrics that look good to investors.

2) Company Culture.

It was heartening to hear upfront that female founders are a lot more focussed on company culture than male founders. From angel investors to Lightbox VC, a fund that has invested in as many as 8 female founders, said that one clear differential was the attention to culture, and enhanced productivity. Some of the female founders also talked about the path-breaking cultures they are setting in their organisations; an ecosystem that’s more supportive of women employees and their needs and doesn’t judge them for needing to take maternity leave for example. The clear message being, “It has to start with us.”

3) Ambition was a hot topic at the roundtable.

While those that had chosen the slow lane, profitability over growth were accused of ‘not being aggressive enough’ an echo we’ve all heard, others pointed out, “Well, if you don’t ask, you don’t get!” There was a clear divide between those that felt not everyone had to be a super aggressive so-called hustler to succeed, and those that felt female founders didn’t stand up for themselves enough, didn’t go out and grab opportunities, and were often too hard on themselves or not loud enough about their achievements.

4) Product fit.

The investors did have one valid point. They said as Venture Capital firms we’re also running a business and we have to find the right fit in a founder and in a business that we feel has potential. We may not always have the perspective that allows for off-beat ideas (there was a push back that non-tech companies find it harder to evince any interest) but we need to find what works for us as a fund. Similarly, entrepreneurs also have to find the right investor for their business. For those that are looking for the perfect fit, it may be worth having a look at Marquee Equity (link here). They have already marked up a few success stories.

5) Diversity applies to us as well.

Ladies who Lead believes it’s essential to have men as part of the continuing dialogue around equal opportunity. The men at the roundtable listened and were constructive. They also appreciated the need for varied perspective and an open mind to inculcate authenticity and inclusion in their funds. It was also agreed across the table that taking inputs from male co-founders, appreciative investors, mentors, and even having a diverse mix of staff in your own companies – all help to create a gender neutral environment. As we fly the flag for recognition and equal opportunity, we must remember that it does truly need to be equal and diverse, and no male, female or transgender entrepreneur should have to face the brunt of subconscious bias.

Ladies Who Lead will be holding roundtables sessions with investors regularly. Do subscribe for more details.

This document has been edited with the instant web content composer which can be found at htmleditor.tools – give it a try.