5 Things they don’t tell you about Starting Up

Blood, sweat and tears, but there is more that goes behind creating a start-up brand that stands the test of time and is attractive to investors.

- You will need a co-founder. And by that we don’t mean your partner (ideally) but a colleague who is able to complement your strengths in other areas. Many female founders are in creative areas like fashion, food and media. Often they require strategic and financial analysis which is something the right co-founder can bring to the table. There is merit to having someone vested in the business in order to truly chart a growth trajectory or future projections that are achievable as a team. The converse is also true, if you’re the money and math person, you will need a co-founder who can build on the paper projections.

- Yes, you will need a good CA and a good lawyer in order to get all the paperwork done. You need to register your company, you need to trademark the name and concept, file for GST and then sit down and work out all your expenses, overheads and any other hidden costs that could come out of left field. You’re a start-up and the chances that your cash flows run out are pretty high. It’s critical to stay ahead of the numbers and know where you stand, and make sure payments are coming in well on time.

- Valuations. You hear about massive funding news all around but the truth is numbers can be made and projected, regardless of what’s actually happening in the business right now. An investor who believes in you and your vision, will look at numbers and how you’re doing, but ultimately resonate with the vision. Most investors though will want to see numbers of scale. You need a valuation report that shows them how you’re valuing your company based on projections. And for this to be valid in future fundraising rounds, you need it done by a CA that’s registered as a valuer (as defined by The Companies Act).

- An investor deck. To even get that meeting with an investor you will need an investor deck where you describe what your business does, the gap in the market, why you’re unique, how you plan to grow and where you intend to use the funds. This is actually a great exercise because it will force you to structure and define your vision. You will get a lot of investor feedback but remember to filter it and adjust the deck based on your vision and what you feel will contribute to make it greater. But remember to add in the numbers and financial information.

- A brand identity. Invest in a brand deck as it helps you to create a brand identity and voice. Done with a marketing expert, in sync with creating your logo and design work, you’d also work on a palette of colours that identify with your brand, the key brand identity, purpose and voice. This messaging will then come through in your social media messaging, your collaterals, collaborations and more. It will help you answer who you are, why you’re doing what you’re doing, and hone in on the kind of impact you’re aiming to have. You can also do frequent user based surveys to help get a sense of whether the messaging is working.

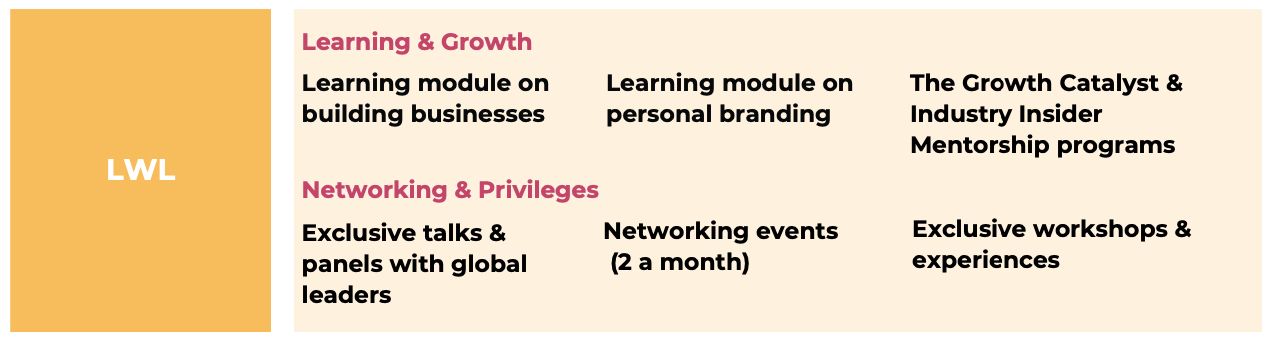

If you are an entrepreneur and have any questions/ concerns, drop them in the comments section below. At LWL we believe in supporting female founders and one of the ways we do this is through ‘Expresso – Funding Female Founders’ where our members get access to a consortium of incredible investors who address all of this and more. Sign up to know more.

About the Contributor

Aabha Bakaya is Founder, LWL and is a career business journalist, news anchor, editor, writer and producer. She has worked for major networks like NDTV Profit, ET NOW & Bloomberg TV India and is currently Consulting Editor and Anchor, BT TV at India Today Group.