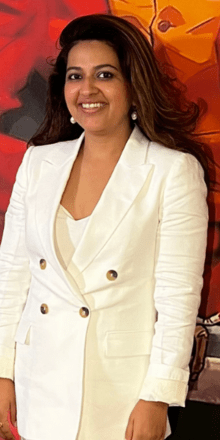

“Most entrepreneurs make the universe rotate around them…” “A female entrepreneur has 1/8 chances of getting funded as opposed to a male.” Anjali Bansal reveals in what she looks for before investing in an entrepreneur.

Anjali Bansal is non executive Chairperson of Dena Bank. She also chairs NITI Aayog Women Entrepreneurship Platform Investment Council.

She has founded Avaana Capital, a fund platform that invests in the scaling up of growth stage businesses. She was previously global Partner and Managing Director with TPG Growth PE, Spencer Stuart India Founder CEO, and strategy consultant with McKinsey and Co in New York and India. She has also been an active angel investor in India with investments in various early and growth stage consumer companies. She started her career as an engineer. She serves as an independent non executive director on the public boards of GlaxoSmithKline (GSK) Pharmaceuticals India, Bata India Limited, Tata Power as well as Delhivery. She is on the Advisory Board of the Columbia University Global Centers, South Asia. Previously, she chaired the India board of Women’s World Banking, a leading global livelihood-promoting institution and continues to be an advisor to SEWA. She is a charter member of TiE, serves on the managing committee of the Indian Venture Capital Association, angel investor and mentor to Facebook SheLeadsTech, NITI Aayog’s Atal Innovation Mission and others. An active contributor to the dialogue on corporate governance and diversity, Anjali co-founded and chaired the FICCI Center for Corporate Governance program for Women on Corporate Boards. She serves on the managing committee of the Bombay Chamber of Commerce and Industry. She is a member of the Young Presidents’ Organization.

She has been listed as one of the “Most Powerful Women in Indian Business” by India’s leading publication, Business Today, and as one of the “Most Powerful Women in Business” by Fortune India